News Summary

The week started with the Typhoon Haikui hiting Taiwan and China. In Taiwan, more than 7000 people were evacuated from high-risk areas, and at least 40 people were injured in the storm.

Now, a brief note about the ageing government representatives in the US.

The top Senate Republican Mitch McConnell, 81, has suffered high-profile lapses but Democrats are reluctant to question his age when Joe Biden, now 80, is America’s oldest president

The question was simple: what are your thoughts about running for re-election in 2026? “Oh,” said Mitch McConnell with a half-chuckle, a mumble and then: silence. The most powerful Republican in the US Senate stared into space and said nothing for more than 30 seconds.

It was the second time in little more than a month that 81-year-old McConnell had frozen while speaking to reporters. But there were few voices in the Democratic party calling on him to step down. The question of age is one that both party establishments in America have cause to avoid.

Democrat Joe Biden, 80, is the oldest president in American history. Republican Donald Trump, 77, is the second oldest and current frontrunner for the party nomination in 2024. The Senate, average age 64, has one of the oldest memberships of any parliamentary body in the world.

If he wins re-election, Biden would be 86 by the end of his second term; a recent opinion poll found that more than three in four Americans think he would be too old to be effective. This week the Guardian reported a claim in a new book that the president has privately admitted he is occasionally tired. Critics faulted Biden’s response to recent wildfires in Maui, Hawaii, in August 2023. The speech he gave there could be characterized as rambling. He mangled the names of Senator Brian Schatz and Mayor Rick Bissen and, in one odd digression, told the latter: “Rick, when we talked on the phone, I never – you look like you played in defensive tackle for – I don’t know who, but somebody good.”

John Zogby, an author and pollster, said: “In all honesty I’ve been a fan of Joe Biden and have tried to overlook some of the missteps but I did see him in Maui and that was troubling. He got to the microphone and started making jokes and then repeated himself three times between his unprepared remarks and prepared remarks. He just did not look good.”

Meanwhile Republican candidates for president such as Nikki Haley, 51, former governor of South Carolina, and Vivek Ramaswamy, a 38-year-old biotech entrepreneur, have called for generational change. Haley, who has called for mental competency tests for candidates over 75, told the Fox News network: “What I will say is, right now, the Senate is the most privileged nursing home in the country. I mean, Mitch McConnell has done some great things, and he deserves credit. But you have to know when to leave.”

The Reserve Bank of Australia maintained its cash rate at 4.1% during its September meeting, extending the rate pause for the third successive month, in line with market expectations. The Bank of Canada also held the target for its overnight rate unchanged at 5% in its last meeting.

Services Purchasing Managers' Indices (PMI) from all around the world have been released, namely from China, Japan, Spain, Italy, Germany, France, and Euro Area. In general, the numbers came lower than forecasts expected, and below 50, indicating a contraction in new orders.

New orders for manufactured goods in the US decreased by 2.1% from the previous month, less than market expectations of a 2.5% fall.

Additionally, in the US, the ISM Services PMI unexpectedly jumped to 54.5 in August 2023, pointing to the strongest growth in the services sector in six months. This was another case of "good news is bad news", which sent yields higher and stocks lower on Wednesday.

Regarding

the financial markets, for the week, the main stock market indices are down, with the S&P500 losing 1.3%, the NASDAQ 100 down 1.4%, and the

RUSSEL 2000 3.6% in the red. Gold and silver lost 1.1% and 5.2%, respectively. The barrel of

WTI rised 1.4% and is now around

87$/barrel. Bitcoin is still around

~26000$.

The relative strength of the US dollar rised 0.8%,

and bond yields increased slightly. US bond yields now sit at 4.27% for the 10-year and

4.34% for the 30-year. The US bond yield curve is inverted and is now peaking at 5.53% in 6 months from now.

Sources:

https://www.theguardian.com/world/2023/sep/03/typhoon-haikui-taiwan-evacuates-thousands-cancels-flights-as-storm-approaches

https://www.aljazeera.com/news/2023/9/3/typhoon-haikui-makes-landfall-in-taiwan-unleashing-rain-and-fierce-winds

https://www.theguardian.com/us-news/2023/sep/03/old-age-mcconnell-biden-trump-politics

https://www.youtube.com/watch?v=ID52HUMe8Vw&pp=ygUPbWl0Y2ggbWNjb25uZWxs

https://www.youtube.com/watch?v=hg50njO60FY

https://www.youtube.com/watch?v=ZSiKsMN44go&pp=ygUVbWl0Y2ggbWNjb25uZWxsIHRyaXBz

https://www.youtube.com/watch?v=w_w3Ihp0OFA

https://www.nbcnews.com/now/video/california-senator-dianne-feinstein-hospitalized-after-a-minor-fall-in-her-home-190490181948

https://tradingeconomics.com

Comment Section

One big trend observed since July is the rise in oil prices, which came up all the way up from the 70$ per barrel level. In the near future, it is possible that oil gets up to 90$ per barrel, as prices are supported by supply cuts from OPEC+ . Saudi Arabia announced that it will extend its voluntary output cut of 1 million barrels per day for another three months to stabilize and balance oil markets. Russia also extended its voluntary reduction in oil exports by 300000 barrels per day until the end of the year. Both countries said they will adjust production monthly depending on market conditions.

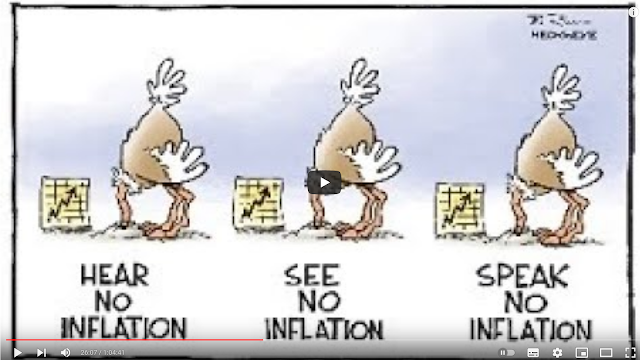

Oil and gas are not only important energy sources, but are also used in numerous chemical processes and in the production of fertilizers. We see the rising oil prices as a threat for resurging inflation. An economy downturn, such as a recession, will put downward pressure on oil prices, but interest rate cuts will decrease the strength of the US dollar, which is supportive of higher oil prices. Thus, we see energy prices remaining steady in the foreseeable future, and energy as an interesting sector.

Have a nice week.

Recommended Videos

Video: Rick Rule: Silver Set To Shoot The Moon - Expect Much A Higher Price Ahead

Channel: Wealthion

Video: Is a digital currency coming? MacGregor warns there could be a hidden agenda - John MacGregor

Channel: The Rich Dad Channel

Video: John Williams Shadow Stats: Inflation Still Above 10%? Real Inflation Has Been Above 2% For Decades?

Channel: WallStForMainSt

Comments

Post a Comment